As investors enthusiastically anticipate the market's trajectory, understanding the performance of key ETFs like SSO becomes paramount. This comprehensive analysis delves into the recent performance of the SSO ETF, focusing on its remarkable returns within the context of the ongoing bull market. The thriving economic climate has fueled growth across various sectors, and SSO has consistently capitalized on this opportunity.

- Traditionally

- The SSO ETF offers a intelligent approach to gaining exposure in the ever-changing market.

Investors seeking stability within a volatile landscape often turn to ETFs like SSO. Examining its performance allows us to assess its potential for future success.

Maximizing Gains with SSO: Analyzing the ProShares Ultra S&P 500 ETF

ProShares Ultra S&P 500 ETF (SSO) provides investors a compelling approach to amplify their returns amidst the dynamic S&P 500 index. SSO, as a leveraged ETF, targets to deliver twice the daily movements of its underlying benchmark. This design makes SSO an attractive option for investors seeking to exploit market upswings.

However, it's crucial the inherent challenges associated with leveraged ETFs is paramount. Daily rebalancing can generate deviations from the projected long-term performance.

Therefore, it's essential for investors to conduct thorough research and meticulously consider their risk tolerance before investing capital to SSO.

Decoding SSO's Outcomes: Factors Influencing the 2x Leveraged S&P 500 ETF

Unveiling the dynamics of the multiplied S&P 500 ETF, known as SSO, requires a sharp understanding of the factors that drive its volatility. A crucial component is the inherent nature of more info leverage, which amplifies both profits and deficits. SSO, with its 2x factor, subjects investors to a heightened level of vulnerability compared to the traditional S&P 500 index.

Beyond leverage, market movements play a central role in shaping SSO's trajectory. A upward market tends to increased returns for SSO, while a negative market exacerbates its deficits.

Additionally, investor sentiment can impact SSO's price. During periods of volatility, investors may move their allocations away from leveraged products like SSO, leading to fluctuations in its price.

SSO ETF vs. SPY: Comparing Returns in Different Market Environments

Investors constantly explore for optimal investment strategies to maximize returns. Two popular choices within the exchange-traded fund (ETF) landscape are the SSO ETF, which provides magnified exposure to the S&P 500, and the SPY ETF, a standard ETF tracking the same index. Analyzing their performance across varied market environments is vital for forming informed investment decisions.

In bullish markets, SSO typically surpasses SPY due to its multiplied structure. However, negative markets can pose substantial risks for SSO investors as losses are increased. SPY, with its standard exposure, mitigates these downside risks.

- Factors influencing the relative performance of SSO and SPY include market volatility, trader sentiment, and macroeconomic conditions.

- Consistently monitoring these factors can help portfolio managers adjust their strategies to align prevailing market conditions.

The Risks and Rewards of SSO: Navigating a 2x Leveraged S&P 500 Strategy

A leveraged exchange-traded fund (ETF) tracking the S&P 500 index, frequently known as a double ETF, presents both enticing rewards and inherent risks for investors. These funds aim to deliver double the daily returns of the benchmark index, luring those seeking amplified exposure to the stock market. However, the intrinsic leverage also amplifies losses, making it crucial for investors to carefully understand the potential downsides before allocating capital.

- Understanding the Impact of Leverage: A Key Factor in SSO Investment Decisions

- Managing Portfolio Risk: The Role of Diversification within an SSO Strategy

- Staying Agile: The Importance of Monitoring and Rebalancing an SSO Portfolio

{Ultimately, investing in a 2x leveraged S&P 500 strategy requires a disciplined approach that demands thorough risk management and consistent portfolio monitoring. While the potential for significant returns exists, investors must be well-informed of the intrinsic risks involved.

Assessing SSO ETF Performance: A Look at Long-Term Growth Prospects

The SSO ETF, known for its amplified exposure to the technology sector, has recently seen shifts in its performance. To truly understand its capacity for long-term gains, investors must analyze a range of factors. A thorough review should include examining historical movements, assessing the current market environment, and considering the ETF's underlying assets.

- Furthermore

- it is essential to comprehend the challenges associated with leveraged ETFs, as their performance can be tremendously sensitive to market movements.

, Consequently, a well-rounded analysis of SSO ETF performance can provide valuable insights for investors looking to exploit the technology sector's potential for growth.

Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Romeo Miller Then & Now!

Romeo Miller Then & Now! Danica McKellar Then & Now!

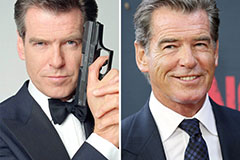

Danica McKellar Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!